Increasing annuity formula

You can increase your PERS 2 pension benefit by increasing your years of service or your income. A market is said to be on the uptrend if the asset prices move in an upward direction ie.

Growing Annuity Payment Formula Fv Double Entry Bookkeeping

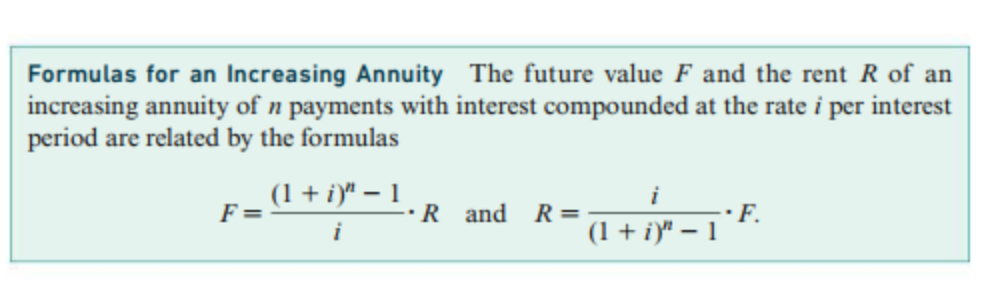

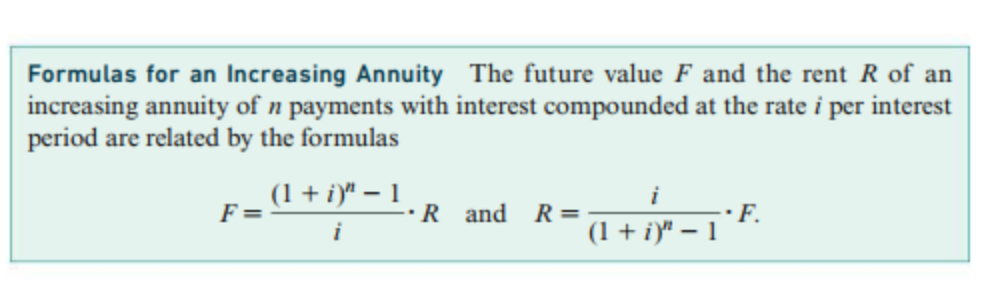

Find the future value of an ordinary annuity if payments are made in the amount R and interest is.

. The grantor will receive a stream of annuity payments beginning with 192614 and increasing by 20 each year. In most cases the annuity account will be depleted after 11 years. The asset allocation of the target date funds will become more conservative as the target date approaches and for ten years after the target date by lessening the equity exposure and increasing the exposure in fixed income investments.

Are there limits to the annuity amount I can purchase. You can use the following Calculator. You can increase your pension benefit by increasing your years of service or your income.

Age 50 up to 60. The annuity payout frequencies available are. Annuity formulas and derivations for present value based on PV PMTi 1-11in1iT including continuous compounding.

To calculate the first payout you can solve the formula used to calculate the sum of the numbers in a geometric progression. Annuity instalments shall be as specified below. 2 x service credit years x Average Final Compensation monthly benefit.

Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency. PSERS Plan 2 formula. Even if the full CSRS COLA rate of 59 or FERS COLA rate of 49 a prorated COLA would result in the annuity rate not increasing 100 is still added.

Keep increasing over a certain period of time. First 5 years of service. 2 x service credit years x Average Final Compensation monthly benefit.

Calculating the Formula Coordinated. But when it comes to total retirement income you have more options. This annuity stream will result in a higher gift tax valuation for the remainder interest of 1017681 because with a growth rate equal to the Sec.

The annuity will be payable in arrears at the end of chosen annuity payment frequency from the date of purchase of the plan. A deferred annuity payable at age 60 or. The combination formula is Cnrnrn-r.

A permanently reduced pension payable as early as age 50 and before age 60. The regular annuity obtained after increasing your service by the time between the date of your retirement and your 60th birthday. A regular formula member can retire between the ages of 62-67 with 10 years of service with a pension reduced 12 of 1 for each month under age 67.

There are worrisome trends in cybersecurity. Yes the minimum purchase. Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments.

Your accrued pension calculated according to the pension formula payable at age 60 or An annual allowance. PERS Plan 2 formula. The higher your income withdrawal percentage will be.

Through an annuity deduction just like one you would use to contribute to a bank or credit union account you can transfer funds to your TreasuryDirect account and purchase savings bonds. A c sin n b -30 3n. Determine if the sequence is increasing decreasing not monotonic bounded below bounded above andor bounded.

The target date is the approximate date when investors plan to retire and may begin withdrawing their money. 7520 rate the beneficiaries will receive 1421730 at the end of the GRAT term. 167 for each year of service.

Cost of Goods Sold Formula in Excel With Excel Template Cost of Goods Sold Formula. The bid-ask spread is the difference between the bid price and asks price that dealers quote and it is the source of the dealers compensation. During your retirement the balance in your annuity savings account decreases by an amount equal to the annuity portion of your retirement allowance.

At least 2 years. Cost of Goods Sold Calculator. Here is how the CSRS annuity formula is calculated.

Most American dividend stocks pay investors a set amount each quarter and the top ones increase their payouts over time so investors can build an annuity-like cash stream. On the other hand a downtrend market indicates that asset prices are moving in a downward direction ie. For all intents and purposes this record keeping is invisible and the reductions do not affect monthly retirement payments.

Unused Sick Leave Unused and unpaid sick leave can be used to meet service eligibility requirements and. Powerball jackpot winners will receive 30 payments over 29 years each payment increasing by 5 - if they choose the annuity options. Yearly Half- Yearly Quarterly Monthly.

Cost of Goods Sold Formula Table of Contents Cost of Goods Sold Formula. A regular formula member can retire between the ages of 55-59 with 25-29 years of service with a pension reduced 12 of 1 for each month under age 60. Yes the minimum.

Trend Analysis Formula Calculator. An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. If you have the first element you can easily calculate the rest iteratively.

Attacks are more sophisticated ransoms are rising and uncertainty is growing. Plus you get the potential for increasing income through the Essential Income Benefit rider which we include automatically for an. But when it comes to total retirement income you have more options.

A fixed index annuity may be a good choice if you want the opportunity to earn indexed interest but dont want to risk losing money in the market. At least 2 years. Are there limits to the annuity amount I can purchase.

But while companies might look to cyber insurance to protect themselves. A portion of each payment is for interest while the remaining amount is applied towards the.

An Annuity Where The Frequency Of Payment Becomes Infinite I E Continuous Is Of Considerable Theoretical And Analytical Significance Formulas Corresponding Ppt Download

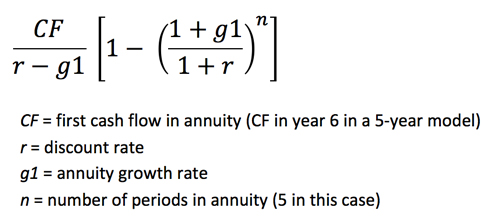

How To Model Multi Stage Terminal Values The Marquee Group

Growing Annuity Equation With Description Tote Bag For Sale By Moneyneedly Redbubble

Present Value Of A Growing Perpetuity And A Growing Annuity Youtube

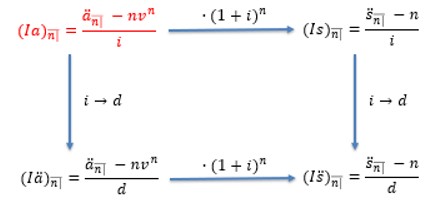

Annuities Cash Flows With Non Contingent Payments Cfa Frm And Actuarial Exams Study Notes

Growing Annuity Formula With Calculator Nerd Counter

Solved Formulas For An Increasing Annuity The Future Value F Chegg Com

Arithmetically Increasing Annuities Soa Exam Fm Financial Mathematics Module 2 Section 6 P1 Youtube

Present Value Of A Growing Annuity Formula With Calculator

Annuity Formula Annuity Formula Annuity Economics Lessons

Present Value Of A Growing Annuity Formula With Calculator

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

Increasing Annuities Youtube

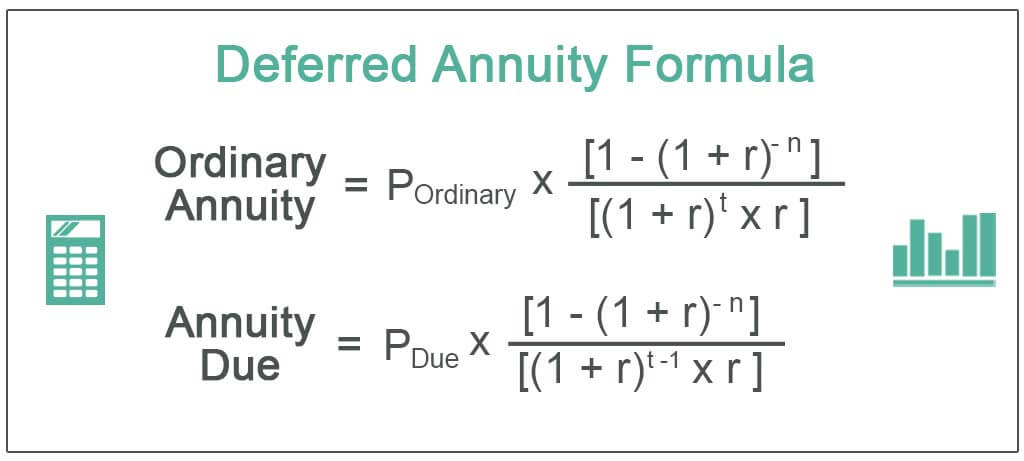

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

12 2 Constant Growth Annuities Mathematics Libretexts

Present Value Of A Growing Annuity Due Formula Double Entry Bookkeeping